History: First Quarter, Jan ~ Mar 2024

Daily: Week 13 (Blog)

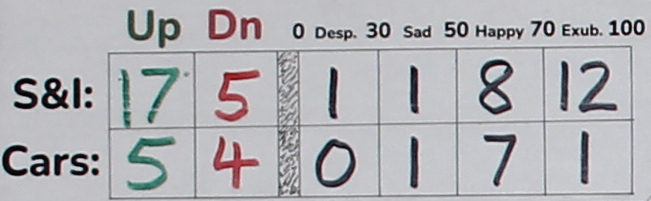

Mar 28, 2024

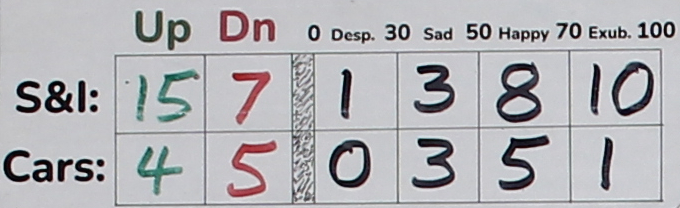

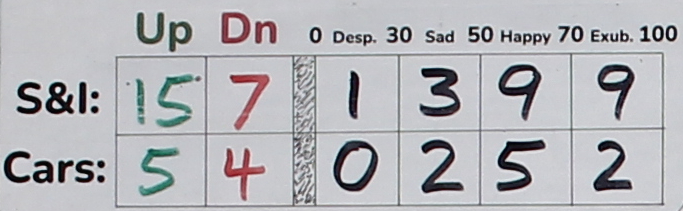

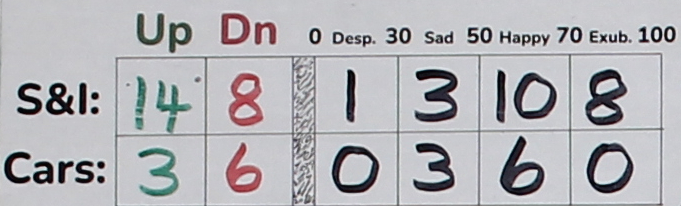

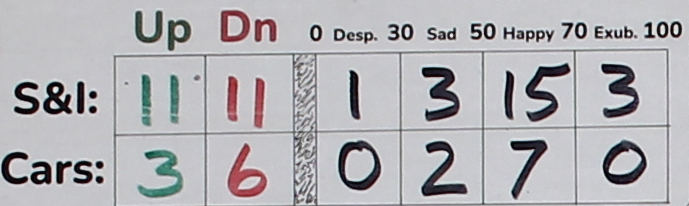

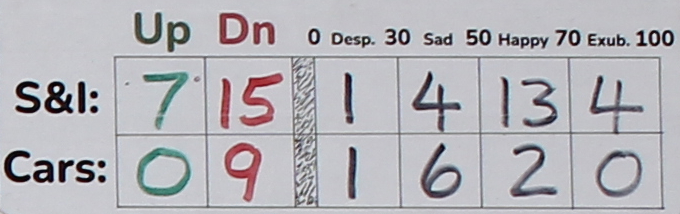

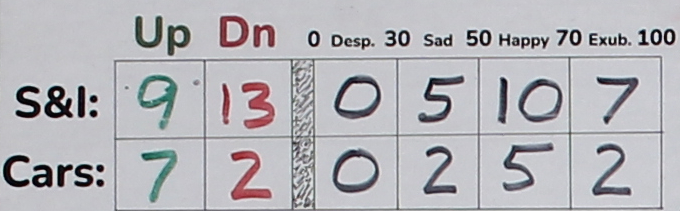

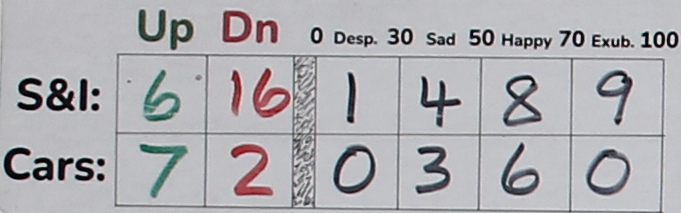

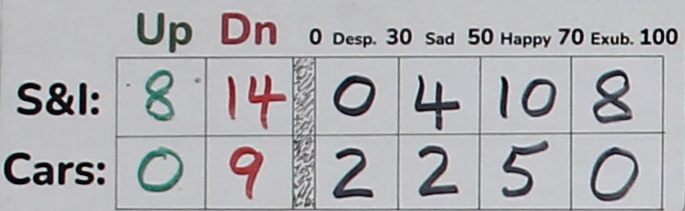

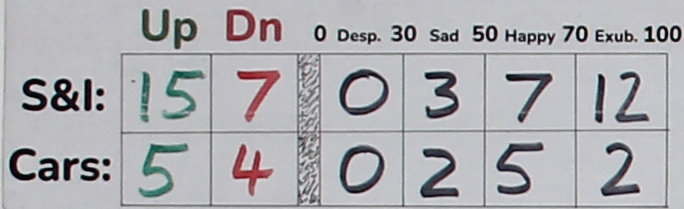

Mar 28, 2024Another up day before the Easter long weekend. Most Cars and half the S&I rose, even though the main prices indexes were about flat. Over half the tags are now in the exuberant zone again.

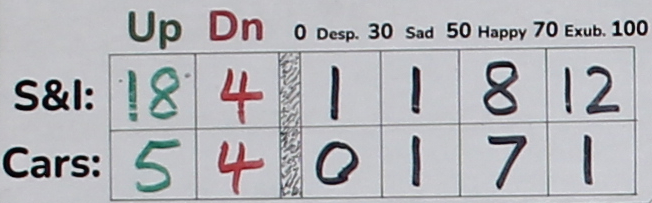

Mar 27, 2024

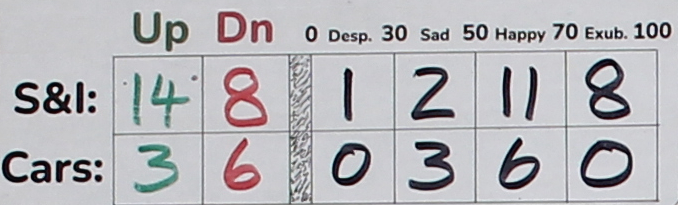

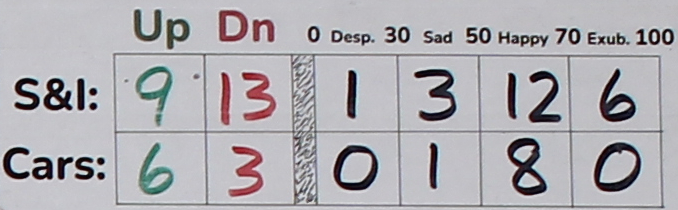

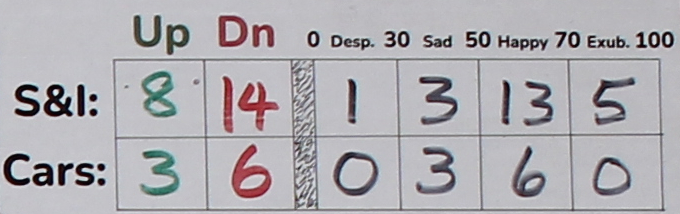

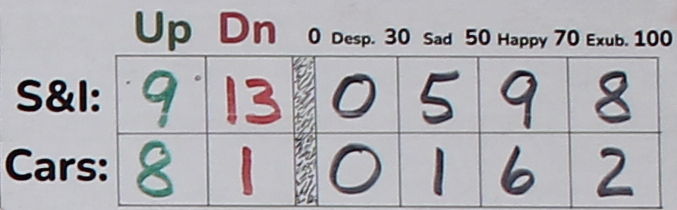

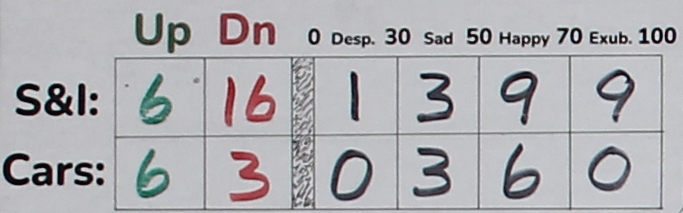

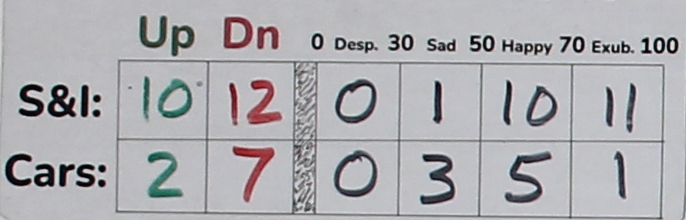

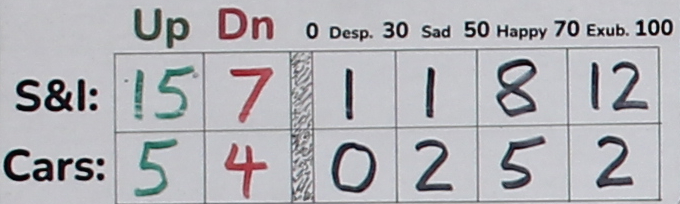

Mar 27, 2024Nice price rally today, especially in the Dow Jones stocks. Strong rally in the Cars, with most turning green and above 70, entering the exuberant zone.

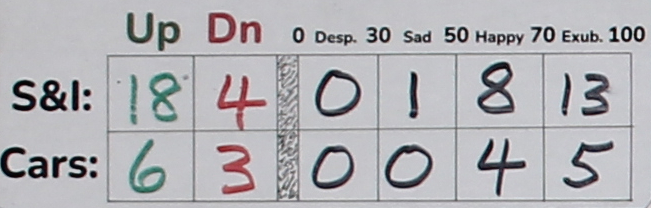

Mar 26, 2024

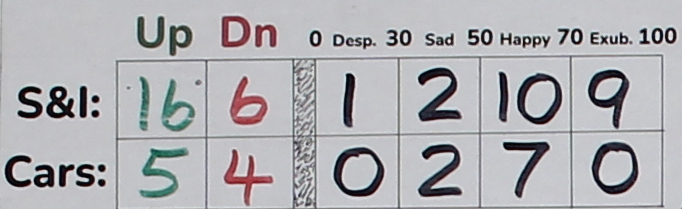

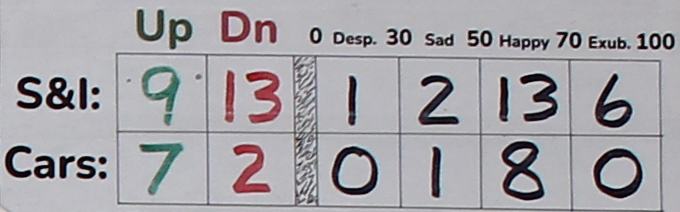

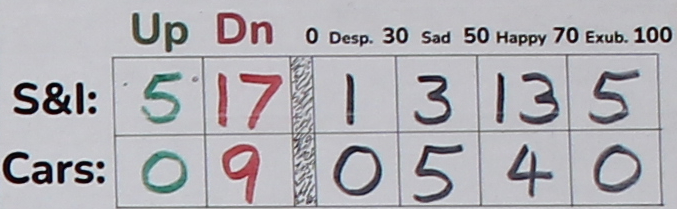

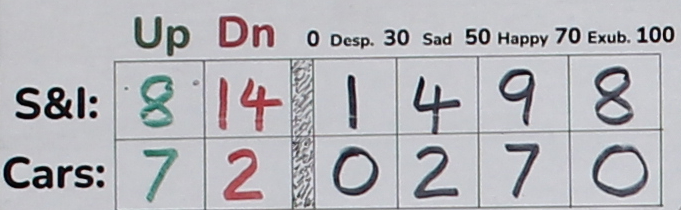

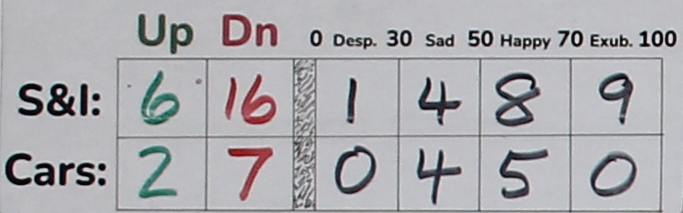

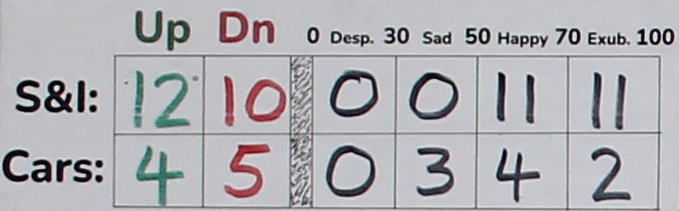

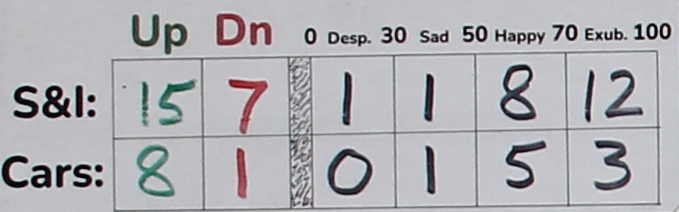

Mar 26, 2024Six Cars moved lower, and a majority are now in down trends. The S&I tags are stalled, but not falling yet other than the Staples tag today. Due to the different definitions of 'rising', the Cars are quicker to react than S&I as conditions change.

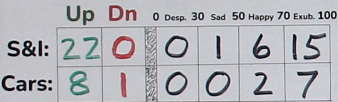

Mar 25, 2024

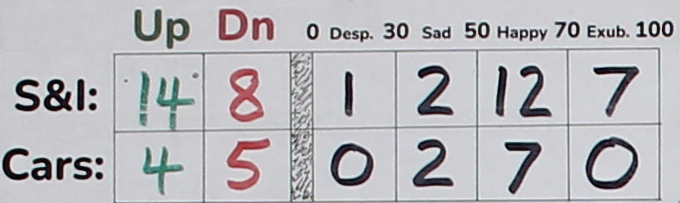

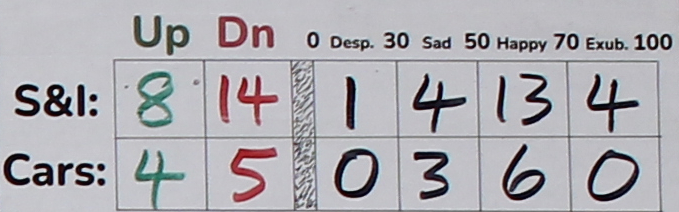

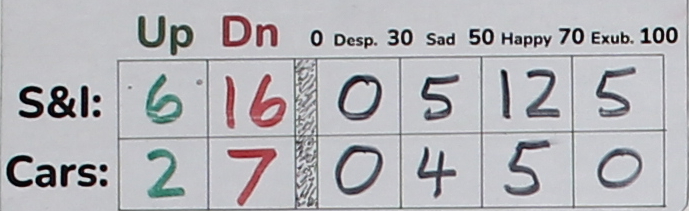

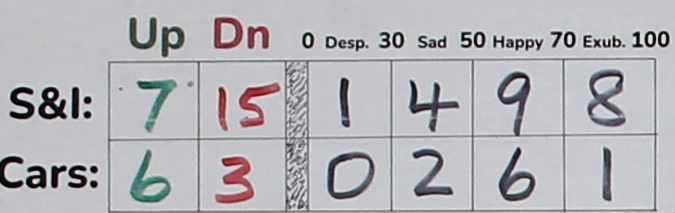

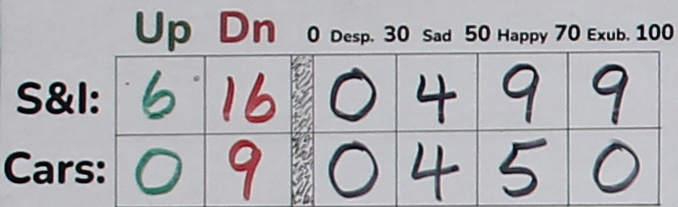

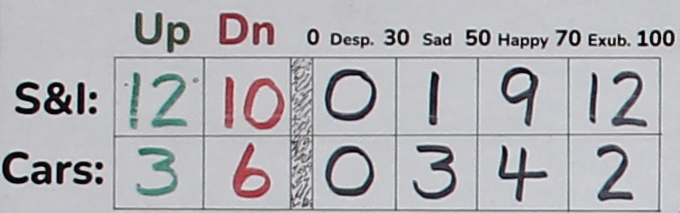

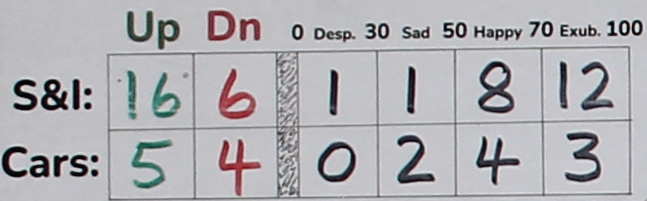

Mar 25, 2024The Cars declined today and another turned red, while S&I barely moved. The Crypto tag moved up sharply, now in green above 50 again. Not much financial news, maybe people are distracted by having children at home during spring break.

Daily: Week 12 (Blog)

Mar 22, 2024

Mar 22, 2024Notice that the Nasdaq Cars are all below 50, while the New York and Toronto Cars are clustered together at 70. All nine Cars fell today, while the S&I barely moved. The game ball remains above 80, while the racing flags are droping toward 50. Have a pleasant springtime weekend!

Mar 21, 2024

Mar 21, 2024Markets are in an increasingly cheery mood, to be expected after a 5-month rally. Funny that seven of the Indexes were up today while the enthusiasm in the Sectors was much less. Mainly the rally was a relief bounce in the NDX.

Mar 20, 2024

Mar 20, 2024FOMC made an agreeable statement. The QQQ short was stopped out, another 1.5% loss on the account. Third loss since January. Today six Cars moved above 70. NDX got back to 50. Thinking maybe best to retire with what cash is left, and leave the trading to you people.

Mar 19, 2024

Mar 19, 2024Cars are fickle. Seven down yesterday, then eight up today. Meanwhile, the NDX tag, in red, broke another five points today to close below 50, which means fewer than half the top 100 Nasdaq stocks are still rising. Probably time to add to the QQQ short position.

Mar 18, 2024

Mar 18, 2024The Sectors and Indexes were steady today, but seven Cars fell. Two jalopies are green, but all the other Cars are red. Bot a small amount of SQQQ for the Moody account.

Daily: Week 11 (Blog)

Mar 15, 2024

Mar 15, 2024Friday. The Cars bounced somewhat, but the NDX tag, after topping near 90 in early Jan, and then hanging +/- 70 for two months, today dropped below 50. The Info tag also dropped a lot. An increasing number of stocks in those groups have stopped rising.

Mar 14, 2024

Mar 14, 2024Maybe a turning of the market is underway. The NDX tag continues slipping, two more Sector tags turned red, and the Cars are weakening. Meanwhile, QT continues and the 10-yr rate is rising. But hey! Microsoft stock made a new all-time high.

Mar 13, 2024

Mar 13, 2024Tags moved up a little more. OEX switched back to green. The game ball entered the exuberant zone. The crypto tag is now at 96, ie. 23 of the 24 coins that we track are rising.

Mar 12, 2024

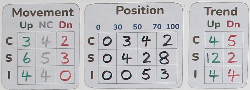

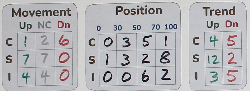

Mar 12, 2024Increased the data content. Added the daily up/down (Movement), plus split the S&I into its two components. Way more numbers now! Maybe simplify to basic graphic instead, something like a shaded graph. With these raw 27 numbers, you need to be a studious geek to appreciate the news.

Mar 11, 2024

Mar 11, 2024The OEX tag (top 100 SPX stocks) turned red today. The NDX tag (top 100 Nasdaq stocks) turned red a week ago. The crowd is 50:50 between happy and exuberant. High position with increasing red is bearish.

Daily: Week 10 (Blog)

Mar 8, 2024

Mar 8, 2024Quiet day on a Friday. Cars and S&I mostly unchanged. The increasing green S&I has moved the game ball above 70 again. The golden bench is at 35, well below the crowd of Extras. Not sure yet whether that means anything, will see.

Mar 7, 2024

Mar 7, 2024The Cars got moving today, all nine up, and clustering toward the 70 line. Gold price has stabilized above $2100, although the miners tag remains in green below 30. Click at left to see the field on any day.

Mar 6, 2024

Mar 6, 2024Chairman Powell of the Fed Reserve gave a calming speech. However, use the link on the bottom of the moody field home page to see that the Fed QT continues relentlessly. Eventually that withdrawl of liquidity will impact stock prices.

Mar 5, 2024

Mar 5, 2024The everybody-included index tags (NYA, NAZ and TSX) have stayed red for two weeks, while the sectors and narrower indexes turned green. Many of those got exuberant. The Cars stayed in the happy zone, none exuberant.

Mar 4, 2024

Mar 4, 2024Gold is coming to life from a low level. Turned green at 25. The bullion price hit a record high above $2100 per oz.

Daily: Week 9 (Blog)

Mar 1, 2024

Mar 1, 2024Same bullish movement. The masses are starting to follow the leaders. Many of the S&I are happy or exuberant. The Cars all rose today, especially in Toronto. Cars are not yet rising like the S&I on the field summary.

Feb 29, 2024

Feb 29, 2024The greening of S&I continues, with another rise in position. The Cars have not changed trend or positions all week. The game ball continues its steady rise, now 64, up from below 30 at the start of the month.

Feb 28, 2024

Feb 28, 2024Notice that the green S&I trend has increased since Feb 21. The S&I positions are moving back into the exuberant zone. All nine Cars moved lower today.

Feb 27, 2024

Feb 27, 2024The MATE tag, Materials, has rising sentiment. The MATE mood tag has gone up over 3 points every day for the past four days. The test is whether that leads to price rises in the component stocks. Will check back in a couple of weeks.

Feb 26, 2024

Feb 26, 2024Another two S&I turned green today. The Sectors are nearing the levels where the Indexes have been stalled for a month. Cars lagging at present, but they are volatile.

Daily: Week 8 (Blog)

Feb 23, 2024

Feb 23, 2024Little changes. Utilities popped up. The Extras are now gathered at 45~65, while the Sectors are moving above that range.

Feb 22, 2024

Feb 22, 2024Big gap up in the markets on the open. All the shorts were sold on stop. Lost 3.5%. Something wrong so far in interpretation of the moody field.

Feb 21, 2024

Feb 21, 2024Starting to think these numbers are not much use to an intelligent speculator.

Feb 20, 2024

Feb 20, 2024The main indexes gapped lower, with a partial recovery later in the day. All nine of the Cars moved lower. Among star players, the NDX and INFO tags led the losers list (both down nine points) while the prices of those two groups only fell 1%.

Daily: Week 7 (Blog)

Feb 16, 2024

Feb 16, 2024Balanced, quiet day before another 3-day weekend. The game ball remains well to the left of the crowd. Resumed the short position that was closed at a small loss on Jan 19. Bot SPXS, FAZ and added SQQQ.

Feb 15, 2024

Feb 15, 2024Second day of recovery from the abrupt sell-off. Trends and positions are gradually strengthening, especially among the Cars.

Feb 14, 2024

Feb 14, 2024Valentine bounce from yesterday's drop. Small price and tag recovery.

Feb 13, 2024

Feb 13, 2024CPI was 0.2 above estimate so stocks opened and closed down about 1.5%. All the Cars had big drops, and are now in the sad field zone. Eight of the S&I made the star losers list, but most are still in the happy zone.

Feb 12, 2024

Feb 12, 2024The Cars strenghend and the S&I tags notched up one point. CPI release tomorrow.

Daily: Week 6 (Blog)

Feb 9, 2024

Feb 9, 2024Same again. Flags and ball got to 35.

Feb 8, 2024

Feb 8, 2024Same again.

Feb 7, 2024

Feb 7, 2024Same again.

Feb 6, 2024

Feb 6, 2024All the Cars bounced higher, but the S&I tags did not. The racing flags and game ball remain under 30. The situation is red on the field while tags are in the happy zone. Not bullish.

Feb 5, 2024

Feb 5, 2024Tags contiued falling today, seventeen down versus one up. All the cars are now red. Appears time to renew the short positions that were closed two weeks ago.

Daily: Week 5 (Blog)

Feb 2, 2024

Feb 2, 2024The main indexes closed at new highs. The field action was different. Only the Staples tag turned green, and all nine of the cars went down.

Feb 1, 2024

Feb 1, 2024Index prices gained back yesterday's drop, but a majority of the S&I tags moved lower. They are in the happy zone now, wearing red. The DJI tag turned red today while the Industrials index made a new high. Moody Field is presently warning to expect a price decline.

Jan 31, 2024

Jan 31, 2024Three S&I tags turned red today, including Info and the NDX. All the Cars declined. Many turned red. Market prices moved lower in response to recent earnings and layoff reports, and today's policy note from the Fed.

Jan 30, 2024

Jan 30, 2024Stability today. Among the Star Players, no wins, no losses, and nobody changed direction. The Cars settled back, but remain in the happy zone. The Crypto tag is green and climbing.

Jan 29, 2024

Jan 29, 2024Green tags contiue gradually increasing for both S&I and Cars. Scroll down the past eight days. The game ball is now at 41, while the racing flags are leading a pack of green cars. The field is now in the happy zone.

Daily: Week 4 (Blog)

Jan 26, 2024

Jan 26, 2024Another quiet day with a narrow trading range. The Crypto tag turned green.

Jan 25, 2024

Jan 25, 2024The S&I tags look like yesterday, except two moved down a zone. A majority of the S&I are red. The game ball remains at 32. Eight of the Cars moved higher today, after eight moving lower yesterday. Cars and S&I tags are differnt, see 'About'.

Jan 24, 2024

Jan 24, 2024The SP500 achieved another new record high, then settled back to breakeven. Eight of the nine Cars moved lower. The tech tags, Tele, Comm, and Info are green while the entire rest of the crowd are red.

Jan 23, 2024

Jan 23, 2024The purple Jalopy turned green, joining the unanimous green vote of the faster Cars. The mood seems to be rising, from a relatively low level. The game ball has been under 30 for four days, but the player tags, mostly wearing red, are not chasing the ball.

Jan 22, 2024

Jan 22, 2024Market happy, another new record high for SP500. The Taxis and Sports Cars are green, the three Jalopies remain red. The INFO tag moved up another 5 points. Possible exuberance warning is the Utilities tag made a 13-point drop.

Daily: Week 3 (Blog)

Jan 19, 2024

Jan 19, 2024Gap-up opening, followed by a strong price rise. Those S and F etfs were sold in the morning on stop. The NAZ tag (all Nasdaq stocks) turned red while the NDX tag (top 100 Nasdaq stocks) turned green. The rally was led by the INFO tag.

Jan 18, 2024

Jan 18, 2024Market prices rose today, led by the Nasdaq up 1.35%. Five of the Cars went higher, but all remain red. S&I now have sixteen red tags. The game ball has moved below 30. Normally tags follow the ball.

Jan 17, 2024

Jan 17, 2024Notice the names moving red at Star Players Today. The NYA tag turned red. Cars and S&I tags are majority red now, while positions are high. Reminiscent of Aug 2023. A dangerous field. Bot more S and F.

Jan 16, 2024

Jan 16, 2024The SPX tag turned red today, not a positive sign. Half the S&I crowd are still exuberant. The Cars all dropped today. Seven of nine are now red, but the majority remain above 50. Lots of room to move lower for Cars and S&I. Bot more SPXS and FAZ.

Daily: Week 2 (Blog)

Jan 12, 2024

Jan 12, 2024Friday before the MLK long weekend. Mostly no change in index prices or the mood tags. Next Friday is the deadline for another political standoff regarding US government budget shutdown.

Jan 11, 2024

Jan 11, 2024Markets moved lower, but recovered by the close. The S&I trend fell today by three tags. The Up green S&I tags have dropped over the past two weeks from 22 to 12. Trends are weakening while field positions are holding up. The field now looks similar to the August 2023 top.

Jan 10, 2024

Jan 10, 2024The Energy tag turned red, while the Crypto tag turned green. Cancelled each other out in the Trend stats. There are still 12 S&I tags in the exuberant zone. The indexes remain green, but have been stepping to the left.

Jan 9, 2024

Jan 9, 2024Quiet day. Eight Cars moved lower, but the S&I tags were steady or rose a bit. Most tags remain in the happy and exuberant zones, where they have been holding since Jan 2.

Jan 8, 2024

Jan 8, 2024The indexes rose in price (SP500 +1.4%), but only two S&I tags moved up. That means the rally was focussed on stocks that were already rising, not new issues joining the party. The cars all rose today, and eight of the nine cars are now green. But a warning: the Staples tag turned red.

Daily: Week 1 (Blog)

Jan 5, 2024

Jan 5, 2024The indexes tried to rise today, but closed break-even. The Real Estate tag turned red. We now have six red S&I tags. Three of those red tags are above 70. Moody Field has been bullish since Nov 1 2023, but we now have a small sell signal. Signal strength increases as the Cars go red, if they do.

Jan 4, 2024

Jan 4, 2024Quiet day. The Energy tag is happy and moved up. The Industrials tag is in the exuberant zone but changed from green to red. Cars were mixed. Not much movement among the indexes. The game ball and racing flag indicators continue moving lower.

Jan 3, 2024

Jan 3, 2024Continuing gradual shift to the left. The Staples tag advanced. Staples are considered defensive issues. The tech tags that went red yesterday moved lower again today. The crypto market had been enjoying quite a run up, but the CRPT tag turned red yesterday, and fell precipitously today.

Jan 2, 2024

Jan 2, 2024First trading day of 2024. Tech had a pull-back, four tags turned red. The taxis all turned red. Looking back, about 40% of the time since 1960 markets fell sharply in the January of a US presidential election year. The present exuberant mood increases the likelihood of that happening again this year.

Dec 29, 2023.

Final day of last year. A wall of green tags and exuberance! A high risk field.

Welcome to Moody Field, 2024.

Designed and produced by Giuseppe Olivotto

© 2024

126