Moody Field was developed through 2023.

The field was initially made with pieces of masking tape and strips of packing tape stuck on my living room wall. After a few months the tape did not stick so well, with tags on the floor in the morning. By summer, the tags migrated to a green magnetic board. That did not show well, so the board was painted white, and a new grid drawn on. Recent improvements include developing the statistical panels, replacing the hand-written tags with printed tags, and using a better camera and lighting.

Click the data panel to view the tags on the field.

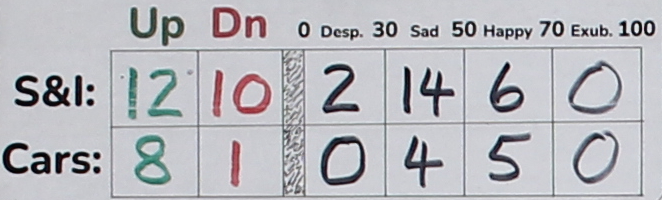

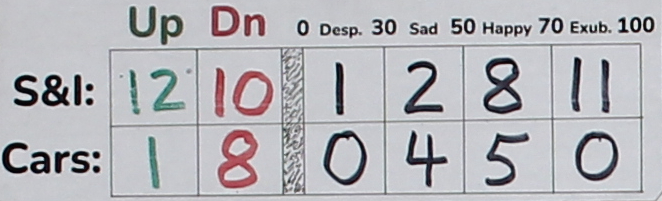

Jan 4, 2023

Jan 4, 2023The markets were driven down by tax loss selling in Dec 2022. Markets bottomed Dec 28, with only four S&I tags green. This Jan 4 state of the field shows that investors have started replacing their sold positions. Prices are rising. Eight of the nine Cars are green. Rising trend at a low position is a bullish combination.

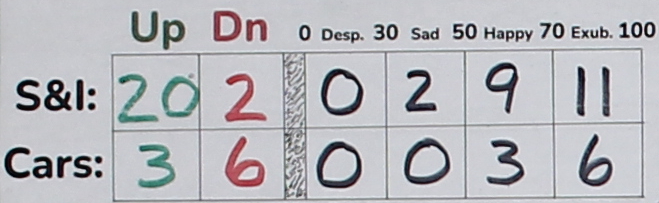

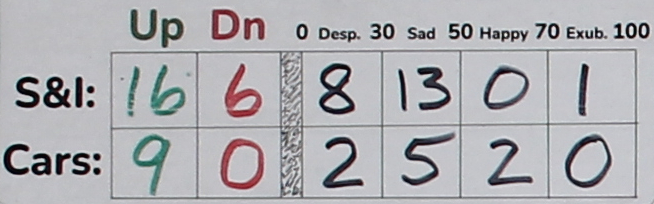

Feb 3, 2023

Feb 3, 2023

For thirty days after the Dec 28 tax loss lows, investors were replacing their positions. Their

buying drove most of the S&I tags to green, and half the field positions to exuberant. Note that here

six of the Cars are exuberant, but have switched to down trends. This condition marked a price top.

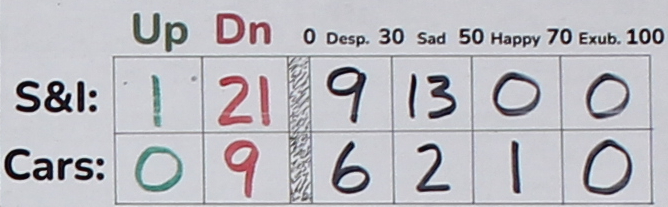

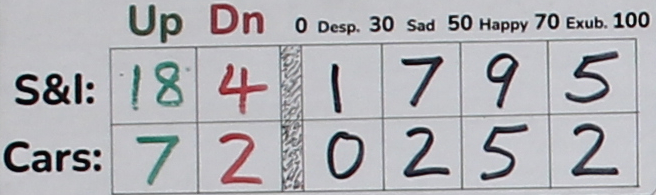

Mar 13, 2023

Mar 13, 2023

Tags that were happy and exuberant in February have moved to the sad and despondent end of the field.

Thirty of the tags are red. The game ball is way down field.

Meanwhile, a bottoming process was underway, emphasized by high trading volumes.

This was the time of a market price low.

May 19, 2023

May 19, 2023

Tag positions by mid-May were balanced at +/- 50. Those below are green; those above are red.

There is a central tendency.

This field condition shows a neutral mood, although the Cars are in an uptrend.

The market stalled for a month, and then continued to rise.

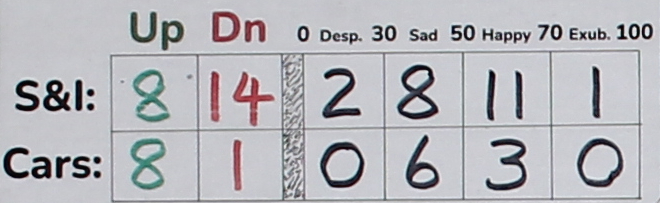

Aug 3, 2023

Aug 3, 2023

A majority of the S&I tags are again in the happy and exuberant zones. Ten of the S&I are red.

The Cars are only at midfield, and eight of the nine Cars are red.

There is plenty of field room to move lower.

Declining trend at a high position is a bearish combination.

Oct 30, 2023

Oct 30, 2023

The mood is at an extreme low ebb. Almost all tags are in the despondent zone, less than 30.

Eight of the nine Cars rose today.

The Cars have lots of room to move up, as do the S&I tags.

The field position today is bullish. This week the US Fed will announce their new policy rate.

Nov 2, 2023

Nov 2, 2023

Three trading days later, there has been a tremendous surge in the number of S&I green tags.

All the Cars have switched into green uptrends.

The positions of tags on the field are rising, but remain mostly below 50.

They have plenty more room to rise. This is a continuing strongly

bullish condition.

Nov 29, 2023

Nov 29, 2023

Field positions have contiued rising through November, and have now achieved the happy zone.

The S&I trend has strengthened throughout the month. Tag positions are now on the high side

of neutral, but are not showing any danger signs yet.

Dec 29, 2023

Dec 29, 2023

Last trading day of 2023. Moody Field shows extreme exuberance, with the game ball sitting at 100

and a majority of tags above 70. This is a high risk condition, even higher risk than on

Feb 3 (see above). The difference here is that the Cars have not yet turned red.

Click the number panel and look at the field in detail for each date.

See how the individual tags changed positions. Moody Field allows you to track relative performance of

market sectors, the Nasdaq market versus the other two markets, and differences among

the short and longer term Cars.

In 2023, Moody Field found three buy times

(Jan, Mar and Oct) and two intervening sell times (Feb and Aug). The year ended at a high

risk level, but not yet a sell signal.

C u with more in 2024!

Designed and produced by Giuseppe Olivotto

© 2024

244